This way, you won’t be burdened with extremely high-interest accumulation over the years and may have a better chance of qualifying for loan forgiveness programs. Remember to repay your monthly due repayments for your school debt consistently. Remember to pay more than the minimum required repayment so you can steadily reduce your debt balance and avoid additional interest charges. One of the best tricks to get out of your credit card debt is incorporating debt repayment into your monthly budget. This expense category includes clothing, shoes, toiletries, cosmetics and toilet products. 13. Clothing And Personal Itemsĭon’t mislook clothing and personal items when organizing monthly expenses for a single person. Then, calculate how much their overall monthly costs are to set aside enough money. Take note of every insurance you pay for, including life, disability, home, car, or rental.

Insurances are must-haves in your personal expenses list. Here, you should include monthly payments for your streaming services, gym memberships and other subscriptions. ChildcareĬhildcare expenses include every cost of providing for your children, including their daycare expenses, supplies, and their babysitter’s wage, if applicable. Include your pet’s insurance expense in your monthly budget to ensure you’re financially prepared in a pet emergency. Pet Careįor this area of expenditure, set aside money for caring for your pet, including food, toys, grooming, veterinary expenses, and other supplies. This may include fuel costs, maintenance, and monthly car payments. Transportation refers to all the costs of your household getting around, whether by car or public transportation. As a reference for budgeting this expense, check how much you’ve spent on food for the past several months. This refers to the cost of your groceries, with or without the budget for dining out. If you have one, don’t forget to include it in your monthly budget. Home insurance provides financial protection for your home’s assets in the event of damage caused by natural disasters or criminal activities. To save money, you can always opt for a cheaper Internet plan.

Don’t forget to include this expense in your budgeting planner.

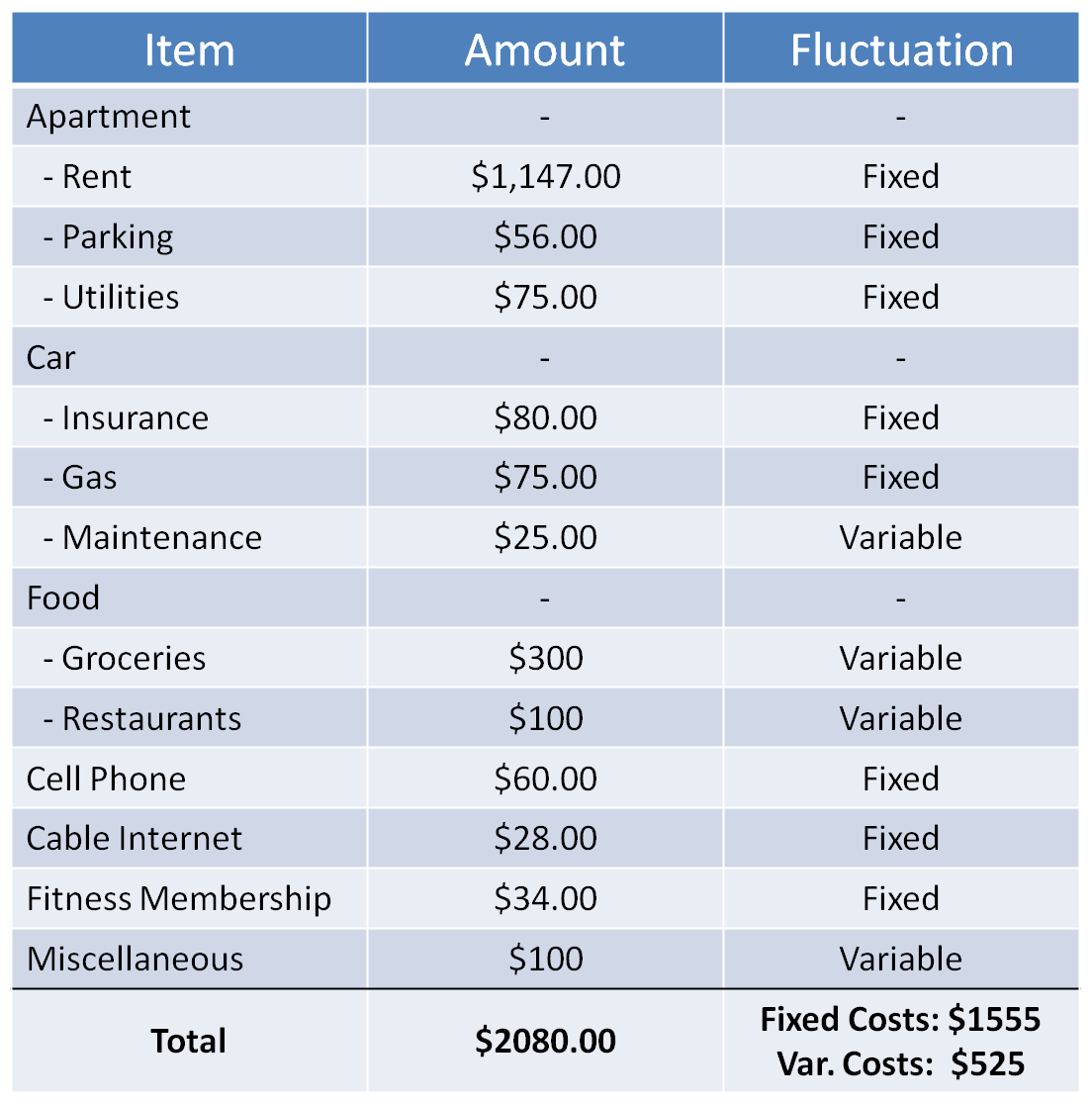

Internet bills usually have fixed monthly costs as long as you stay within your allowed data usage. If you’re budgeting for the entire family, sum up every monthly phone bill you pay using your household budget and allocate that much money for your phone bill expenses. Then, use the most expensive bill as a budget reference for each utility to ensure you budget enough to cover the highest possible cost. So, check your utility bills for the last three months. Your electricity, gas and water bills may vary slightly. Rent or housing usually takes up the biggest portion of many Canadians’ budgets. This expense includes rent, mortgage payments, and home or apartment maintenance. Use the personal and household expenses lists below as starting points to help you decide what to include in your monthly budget. However, some expenses that shouldn’t be left out for many Canadians are rent, utility bills, insurance, debt repayments, transportation, emergency fund and food. Separating your budget into fixed expenses, savings expenses, and variable costs will help you organize your bank accounts and manage your money properly.The expenses you should include in your monthly budget will depend on your specific life situation, including your age, number of dependents, priorities, debts, and financial goals.

#List of typical household expenses how to#

How Will Fixed, Savings and Variable Costs Help Me Learn How To Budget My Money Properly? Sometimes expenses will fit into more than one category and if that happens, you can choose where you feel the cost belongs in your budget. Should I be saving for this item in advance? (Savings).Do I buy it from a store? Can I control how much I spend on this? (Variable).Does this expense occur often, regularly and not change? (Fixed).If you find an extra expense in your budget and you’re not sure if you should put it under the fixed, savings, or variable costs, simply ask yourself these questions: It lets you know what "normal" expenses would be for your financial situation, and once you're done, it can review your budget and look for dozens of ways to help you improve it or save money.Įxtra Expenses – Are They Fixed, Savings, or Variable Costs? As another way to help making budgeting simpler and more fun, we've created a personal budget template that guides you through the budgeting process.

0 kommentar(er)

0 kommentar(er)